At that point, you have no debts other than the mortgage, and you have $10,000–15,000 in the bank just for emergencies.

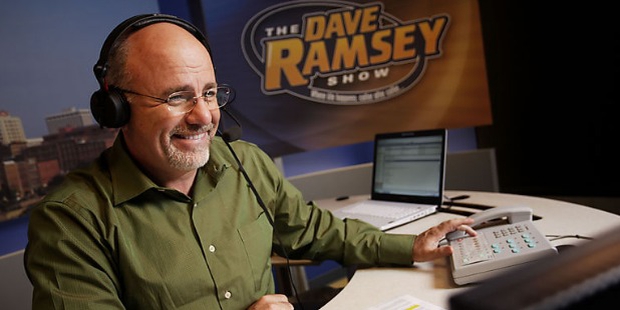

DAVE RAMSEY SUCCESS STORY FULL

Once you’re out of debt except your house, go back to that little emergency fund and beef it up to a full 3–6 months of expenses. Step 3: Build a Fully Funded Emergency Fund of 3–6 months of expenses.

By the time you get near the bottom of your debt list, it starts to look like an avalanche! You’ll be debt-free faster than you ever thought possible! That’s why we call it the Debt Snowball: As the snowball rolls over, it picks up more snow. Every time you pay off one debt, you have more money to throw at the next one. Keep going all the way down the list, one debt at a time. Make minimum payments on all of them except the smallest one, and attack that one with a vengeance! Put every dollar you can get your hands on toward that smallest debt, and get it out of your life for good! Once the first one is out of the way, take that money and add it to the next debt on the list. List all your debts except your house, from smallest to largest by balance. Step 2: Pay off all debt with the Debt Snowball. Having $1,000 set aside just for emergencies puts a little buffer between you and the “Check Engine” light on your dashboard. Don’t be one of the 60 percent of Americans who can’t cover unexpected expenses.

An emergency fund takes care of these not-so-happy surprises. Step 1: Save $1,000 in a Beginner Emergency Fund. The Baby Steps are based on the idea that you can accomplish anything if you take it one step at a time. But taking control of your money doesn’t happen overnight.

DAVE RAMSEY SUCCESS STORY HOW TO

These seven money markers are designed to get you out of debt and show you how to build the kind of wealth you always dreamed of. The pile of debt in front of them seemed too big, and they didn’t know how to start. The thought of getting out of debt was overwhelming to them. It’s been awesome to see so many people change their lives!Įarly on, however, I noticed a pattern with the people I was counseling and the callers on my radio show. The company wins, because it has a truly valued and productive team member, and the player wins, because they know they’re valued and respected.Īnd that extra money in their pocket every payday doesn’t hurt, either!ħ steps to living the life of your dreamsįor more than 20 years, I’ve had the honor of helping millions of families take control of their money and stop drowning in debt. This is a time for celebration, because it’s a true win-win scenario.

Praise the person and their actions and talents, give the raise, and praise the person some more. Other times, a person may have personal issues outside work that require a little understanding, counseling, and grace.įor players who are consistent contributors year-in and year-out, raises should be given happily and with a praise sandwich. Sometimes, if a team member is underperforming, additional training or education is needed. People are more than simple numbers on a weekly report, and as a leader you have an obligation to provide your team with everything they need to succeed. I almost never cut a team member’s pay due to poor performance. Others, unfortunately, will have an unrealistic view of what they’ve brought to the table. At some point, each and every one of them is going to have that Jerry Maguire moment where they say, “Show me the money!” Inevitably, some of these team members will deserve for you to be more generous. Your team is filled with players holding varying degrees of tenure, talent, and maturity. But if you’ve brought value to the company, if you’ve made us money and shown yourself to be a valuable contributor-one who goes out, kills it and drags it home every day-you bet you’re going to be rewarded. Just because you’ve been breathing air in the same building for 365 days doesn’t qualify you as raise-worthy in my book. Even after 20-plus years of running my own business, I love how a team member’s face will light up when they hear that they’re appreciated-and that appreciation is being shown through an increase in pay.Īt my company, we don’t give out raises based on longevity. Your raise is effective when you are Raises are almost as much fun to give as they are to receive.

0 kommentar(er)

0 kommentar(er)